Wealth Management in Carmarthen: Your Path to Financial Success

In today's rapidly changing economic landscape, wealth management has never been more crucial. For residents of Carmarthen and its surrounding areas, understanding how to effectively manage wealth can mean the difference between financial stability and uncertainty. This extensive guide aims to provide you with valuable insights, expert advice, and practical tips on navigating the complexities of wealth management in Carmarthen.

The Importance of Wealth Management

Wealth management is not merely about managing assets; it encompasses a wide range of services to help individuals achieve their financial goals. Here's why it matters:

- Comprehensive Financial Planning: Wealth management offers a holistic approach to personal finance, covering everything from investment strategies to retirement planning.

- Asset Protection: Effective wealth management ensures that your assets are protected against unforeseen circumstances, such as market fluctuations or personal crises.

- Tax Efficiency: Professionals in wealth management are skilled in devising strategies to minimize your tax liabilities legally.

- Legacy Planning: A solid wealth management plan includes provisions for passing down wealth to future generations smoothly.

Understanding Wealth Management Services in Carmarthen

In Carmarthen, various institutions and professionals offer wealth management services tailored to meet diverse financial needs. These services can typically be categorized into the following areas:

Investment Management

Investment management involves the professional handling of various securities and assets in order to meet specified investment goals. Here are some critical aspects:

- Portfolio Diversification: Spreading investments across a range of asset classes to minimize risk.

- Risk Assessment: Evaluating the risk tolerance of clients to tailor investment strategies accordingly.

- Market Research: Staying updated with market trends to make informed investment decisions.

Financial Planning

Comprehensive financial planning touches every facet of a client's financial life. Key components include:

- Budgeting: Creating a budget that aligns with personal financial goals.

- Debt Management: Strategies to manage and reduce debt effectively.

- Retirement Planning: Establishing a roadmap to secure financial independence during retirement.

Tax Planning

Effective tax planning can significantly impact your overall wealth. Here’s what you should consider:

- Tax-Advantaged Investment Accounts: Utilizing accounts like ISAs or pensions to maximize your returns.

- Capital Gains Management: Strategies to minimize taxes on investment returns.

- Tax Loss Harvesting: Techniques to recognize losses to offset gains.

Estate Planning

Estate planning is essential for ensuring your wishes are honored after your passing. Important elements to consider include:

- Wills and Trusts: Arranging how your assets will be distributed.

- Power of Attorney: Designating someone to make decisions on your behalf if you cannot do so.

- Healthcare Directives: Documenting your healthcare preferences.

Finding the Right Wealth Management Advisor in Carmarthen

Choosing the right wealth management advisor can significantly influence your financial trajectory. Here are tips for selecting the right expert:

- Check Qualifications: Look for advisors with recognized certifications such as CFP (Certified Financial Planner) or CMA (Chartered Management Accountant).

- Consider Experience: An advisor with extensive experience in wealth management will better understand the local market.

- Assess Their Approach: Understand whether their management approach aligns with your financial goals and risk tolerance.

- Fee Structure: Evaluate their fees—whether they’re commission-based, fee-only, or a hybrid approach.

Common Wealth Management Strategies

There are several strategic avenues you can pursue when managing your wealth:

Diversifying Investments

Diversification is a cornerstone of a successful investment strategy. By investing in various asset classes such as stocks, bonds, real estate, and commodities, you can mitigate potential losses while capitalizing on growth opportunities.

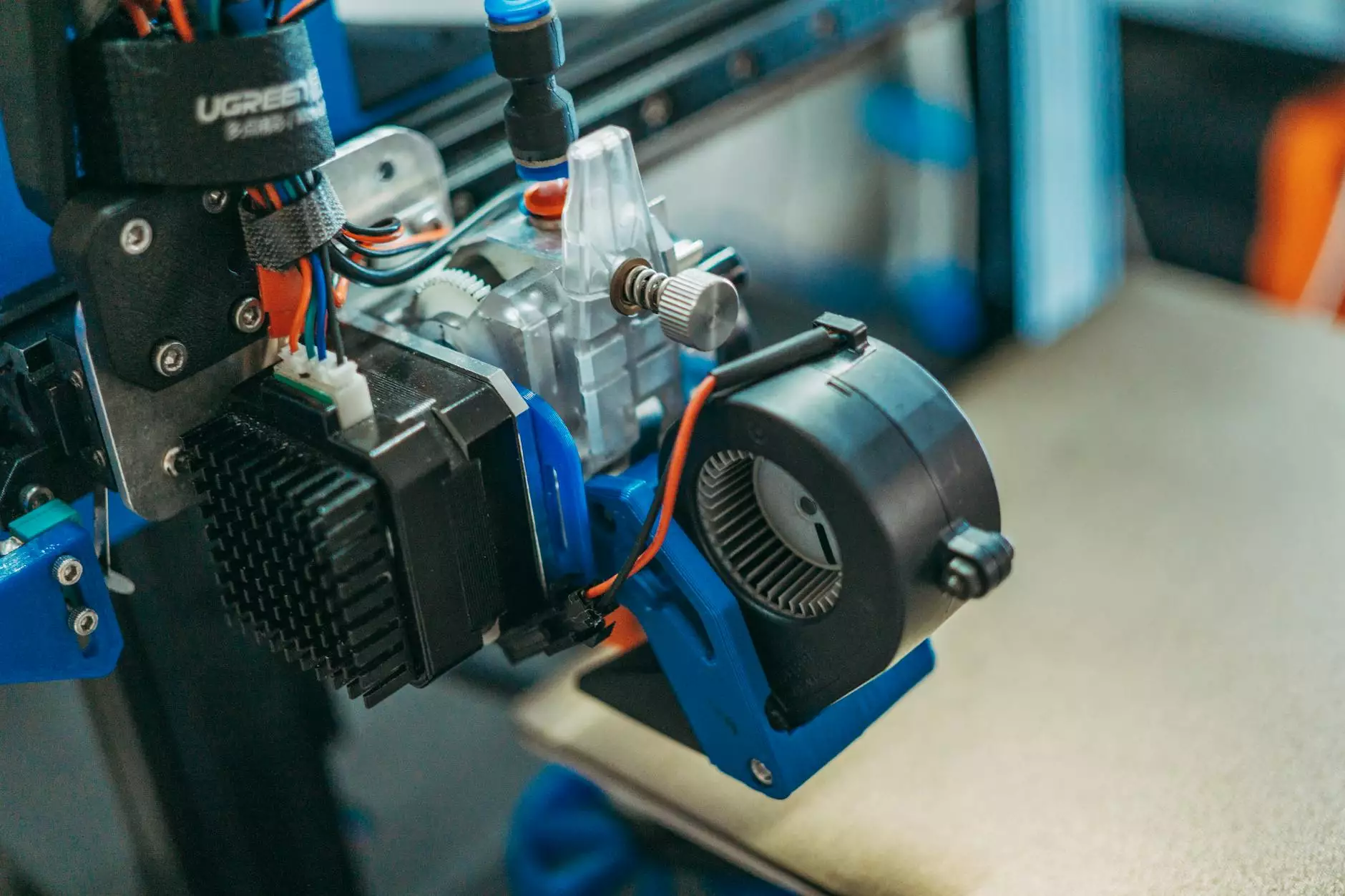

Utilizing Technology in Wealth Management

The rise of fintech has transformed how individuals manage their finances. Roboadvisors and finance apps now offer personalized wealth management solutions that were once only available through traditional advisory means.

Regular Reviews and Adjustments

A wealth management strategy is not a set-it-and-forget-it plan. Regular reviews are vital to ensure that your investments align with your evolving goals and market conditions.

The Local Economic Landscape in Carmarthen

The local economic landscape of Carmarthen plays a significant role in shaping wealth management strategies. With a blend of traditional industries and growing sectors, understanding the economic environment is crucial for effective wealth management.

- Real Estate Market Trends: With rising property values, real estate investment is becoming increasingly attractive in Carmarthen.

- Business Growth: The growth of small to medium enterprises in Carmarthen presents unique investment opportunities.

- Tourism and Local Investments: The rich history and culture of Carmarthen create unique opportunities in tourism and local businesses.

Case Studies of Successful Wealth Management in Carmarthen

To illustrate the impact of effective wealth management, let's examine a few case studies:

Case Study 1: Retirement Planning for Local Business Owners

A local business owner, nearing retirement, sought the guidance of a wealth management advisor. Through comprehensive planning, they established a diversified portfolio that ensured a comfortable retirement, thus achieving their long-term financial independence.

Case Study 2: Real Estate Investment Success

A young couple looking to invest in real estate in Carmarthen consulted with a wealth management firm. With careful analysis and guidance, they navigated the property market successfully, building a substantial asset portfolio.

Conclusion

Wealth management is an essential aspect of securing your financial future, especially for individuals in Carmarthen. By understanding the importance of effective wealth management, exploring the services offered, and choosing the right advisor, you can effectively manage your assets, minimize taxes, and plan for a prosperous future.

Always remember that the journey to financial security is a marathon, not a sprint. Stay informed, remain engaged, and adapt your strategies as necessary to prosper in the evolving financial landscape.

To explore personalized wealth management strategies tailored to your unique financial situation, visit robertsboyt.com. Discover how expert guidance can lead you towards achieving your financial goals today!

wealth managment carmarthen